Last Updated on 05/07/2019 by Mark Beckenbach

The new B&H Payboo Credit Card has a higher purchase APR than Chase bank.

Last night, a number of B&H Photo affiliate partners were sent an email about a new way B&H Photo is trying to change the game for online purchasing. The new system is called Payboo, and once you get past the eye-roll-worthy name, you begin to see some great ideas. The premise behind Payboo is that B&H Photo is trying to go back to the way things were when they didn’t need to charge state sales tax for online sales. Amazon and others need to do this according to the law, and when you think about it ethically it makes sense to pay your state taxes anyway. Since they had to make that change, B&H Photo lost a competitive edge as even New York residents (where the company is based) would ship a product to a friend to Jersey and then have said friend bring the goods to NYC for them.

Editor’s Note: People seriously don’t read these days. Take a few minutes and educate yourself.

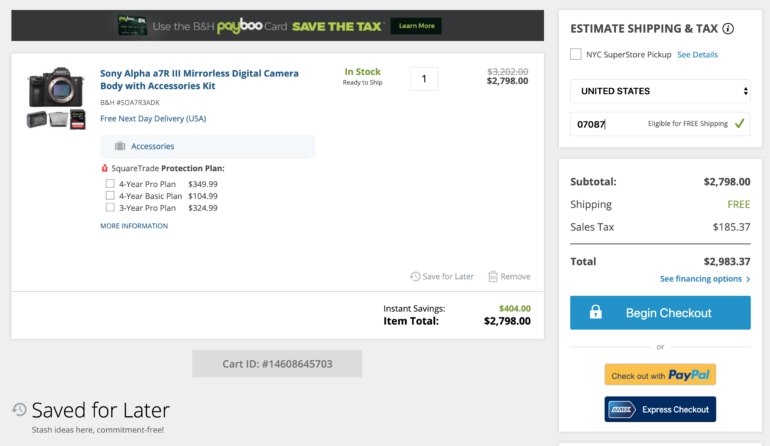

Payboo works by making you sign up for the B&H Photo Payboo credit card. Then, when you make a full purchase with the card, B&H looks at whatever state you’re in, takes the sales tax charge, and gives it back to you as credit rewards. What that means is that if I’m in New Jersey, B&H currently has to charge me sales tax based on my zip code. The armpit of America currently has a 6.625% sales tax. In real life matters, a Sony a7r III accessory kit from B&H would then cost me an additional $185.37 in sales tax. But with Payboo, I’d be getting that money back in rewards (that can only be used at B&H Photo). This is great, except that folks aren’t really talking about the really big problem here.

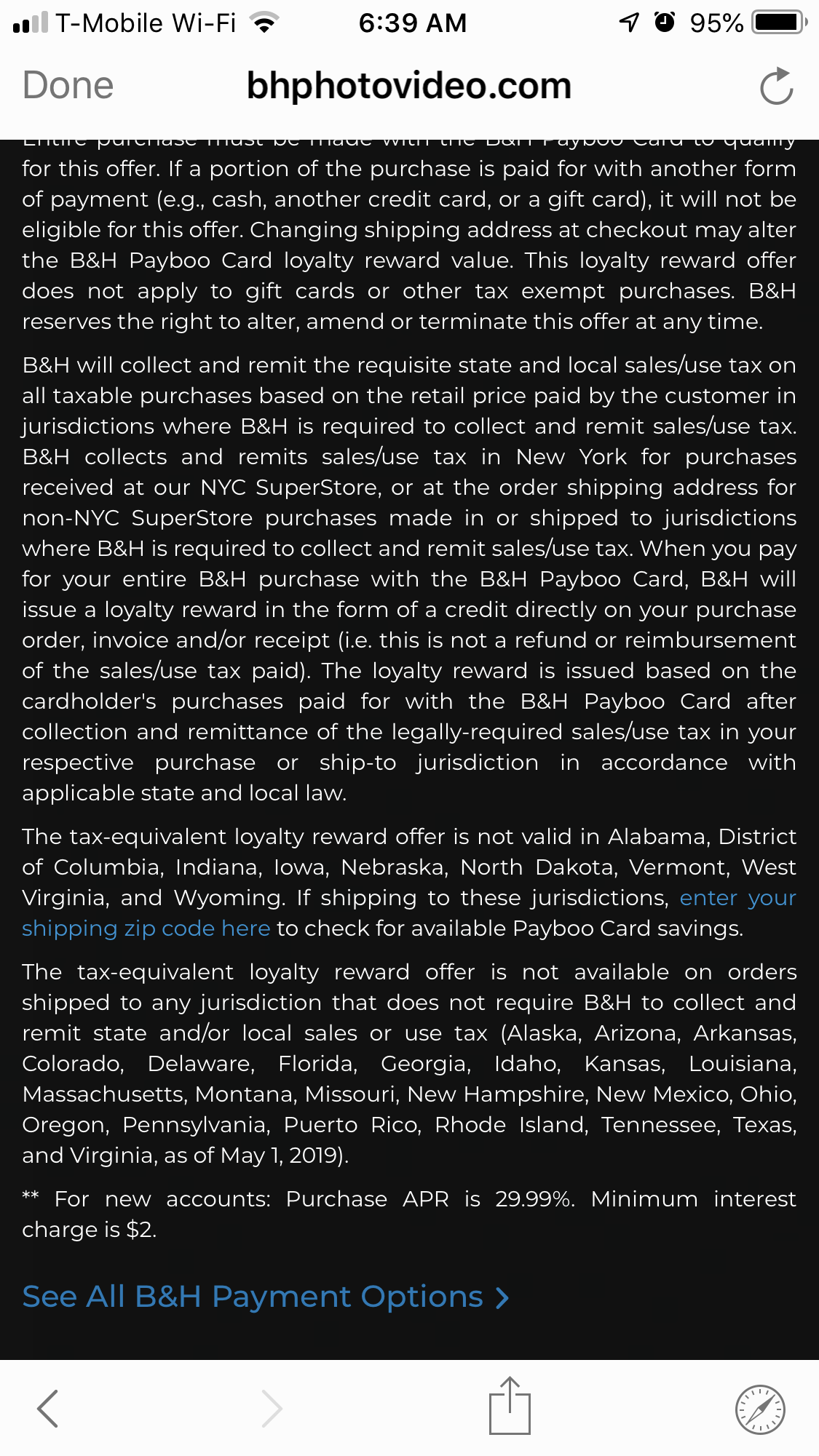

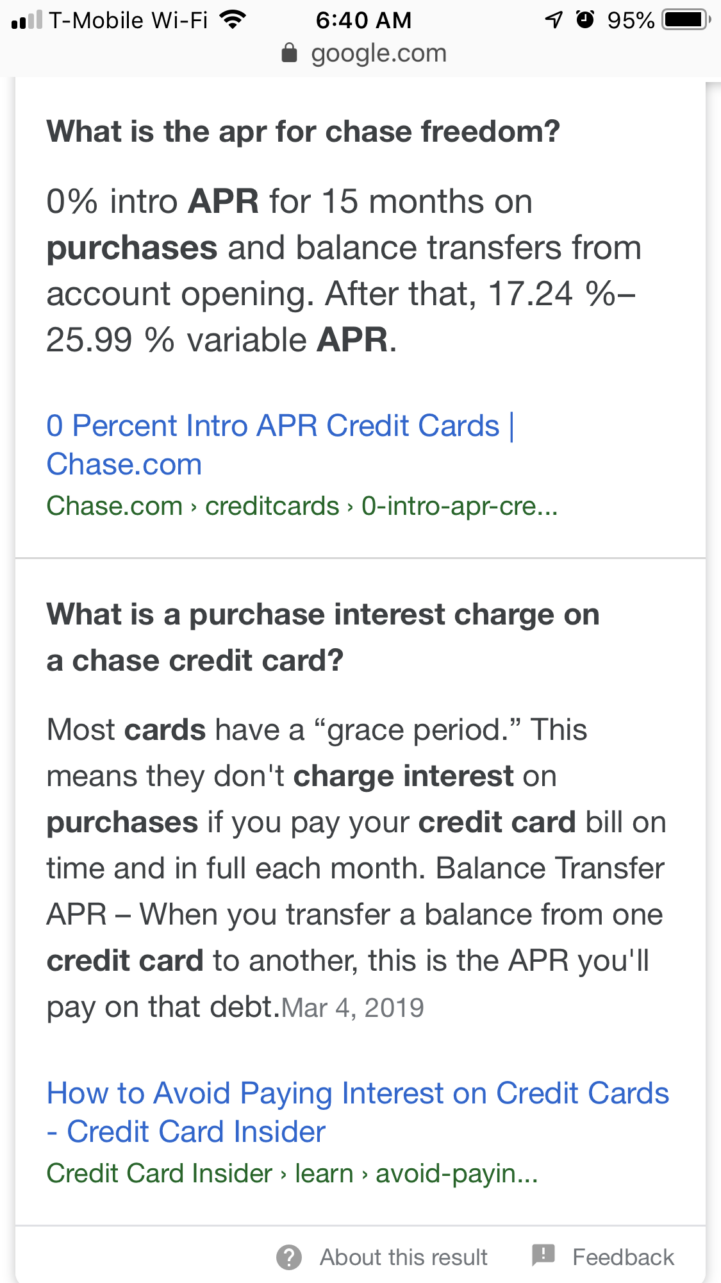

PayBoo’s new customers (which would most likely be everyone going forward) will charge you at a 29.99% APR. For those of you who don’t know, APR means interest charge. What that means is if you need to make a purchase on your card, pay it off pretty much immediately or else you’ll get charged the 29.99% APR (instead of paying the $6.625% NJ sales tax for example). No state in the US charges you nearly 1/3rd in sales tax. That would be absurd. But if you miss your payment, then B&H will charge you a whole lot more. If you’re disciplined with your finances, then you’re okay – until you get that interest charge you’re signing up for. The truth is that most people have credit card debt. And if you want to pay even more money, then go right ahead and use PayBoo. Comparatively speaking, a Chase Freedom card is less expensive. And at least with Chase, I can use the rewards on Amazon, at a rotating number of stores, on airfare, etc.

Editor’s Transparency Disclaimer: The Phoblographer is an active B&H Photo affiliate partner, but we haven’t actively promoted their sales offerings in years.

Update: B&H Photo’s Stuart Honickman reached out with a response:

How does the Payboo Card benefit really work?

When you pay for B&H purchases with the Payboo Credit Card, B&H will charge the total of merchandise plus applicable fees and taxes; but we instantly issue and apply a reward on orders made in our SuperStore or shipped to eligible states right in checkout as a form of customer payment. Then, the amount charged to the Payboo Card is net of the benefit applied. Meaning there are No Rewards for future purchases…the benefit is on the initial Order !!!

In truth, B&H does not charge or keep any of the interest charged. That’s the Bank !!!

This sounds pretty shady to me.