Canon continues to claim that the camera market is going to nosedive to depths the industry hasn’t seen in many years.

Earlier this year, Canon stated that the declining camera market had forced them to change their entire business strategy because of the rise of smartphone photography. Other manufacturers such as Fujifilm said they didn’t see a market decline at all. Ever since that statement from Canon, there has been speculation about the current state of the camera market and where it will end up. Canon, it seems, is still planning for doomsday, but are the others? Will the declining camera market force one or more of the big players out of business in the next two years? Let’s talk about it.

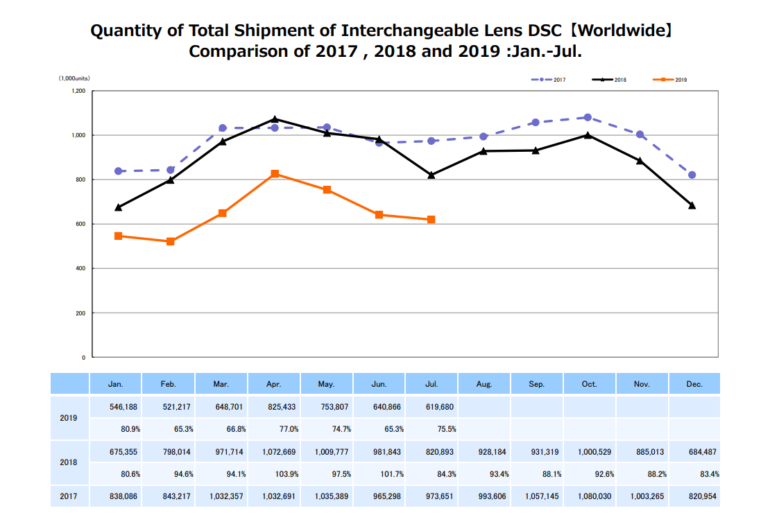

If you’ve been keeping up with the shipment reports from CIPA, you’re aware that camera shipments around the globe have been tumbling for some time. Year-over-year sales are down, and therefore, profits have also fallen for all but Sony and Fujifilm.

Canon’s CEO, Fujio Mitarai, believes that in two years, the camera market will see only five million ILC cameras shipped per year. Mitarai also believes only 10 million point-and-shoot cameras will be shipped per year. Doesn’t sound too crazy but, when you look at camera sales from 2012 and see 18 million ILC cameras were shipped, the problem becomes more evident. In 2008, point-and-shoot cameras hit 114 million units shipped. That’s a massive decline of 104 million units shipped per year in just 11 years.

An article over at Photo Rumors shared a recent interview that Canon CEO Fujio Mitarai gave to Digital Camera Info. During the meeting, Mitarai shared the same prediction that was given earlier this year about the camera market. He expects that by 2021/2022 camera sales will slow to a crawl. Canon believes that the rise of smartphones has hurt the camera market more than anyone predicted. Mitarai is probably right about this when it comes to sales of point-and-shoot cameras. That market is now past the point of no return, and I think that whole segment will die relatively soon. But ILC cameras are a different matter.

I believe camera manufacturers are doing more harm to themselves by releasing new ILC cameras at a much faster pace than we’ve ever seen before. All eyes are on you, Sony. Cameras have become so technologically advanced that upgrading to the latest and greatest is not necessary every year or two. These companies are cannibalizing their own markets, and this, along with ongoing trade wars, is why ILS Shipments will continue to fall.

Seeing as companies like Canon and Nikon have relied so heavily on consumers snapping up their cheap point-and-shoots in the past, you can understand why the despair is there. There is no doubt that point and shoots have been killed by smartphones. Canon has already changed course and said they will narrow their focus to only producing premium cameras and the other industries that require their optics. Canon has a game plan in place, but what about the likes of Nikon, Fujifilm, Sony, Panasonic, Olympus, and Pentax? Will these companies be able to course-correct in time?

I think that with Canon changing their strategy to focus on only premium cameras going forward, they will be okay. Canon might regain the considerable market share they used to have, but their ship will more certainly stabilize and they will live on. Their move to Mirrorless will pay off, and their superior optics will help them immensely. Fujifilm is another company that will go from strength to strength. They have carved out a niche market with their APS-C and Medium Format approach, and things seem to be going rather well for them.

While Nikon has gotten off to a rocky start with their Mirrorless cameras, they are here to stay. They will course-correct just like Canon. Their user base spreads so far and wide that they will weather the storm. Professionals rely on Nikon, and their legendary build quality will make sure that remains the same for years to come. Sony, well what needs to be said about Sony? They basically own the sensor market, and they continue to push the boundaries when it comes to Mirrorless cameras. Sony is the company to catch up to now.

The skies begin to darken when we look at Panasonic and Olympus. Panasonic has recently jumped into the Full Frame market with their S1 and S1R cameras, and they are a part of the L Mount Alliance along with Sigma and Leica. They too are beginning to course-correct, but whether or not their late entry into Full Frame Mirrorless cameras will be a success is unknown. They are already feeling the heat of the competitive Full Frame camera market, as evidenced by the substantial price cuts on the S1 and S1R. Only time will tell for them. Olympus continues to play in the Micro Four Thirds market, and that is fine. I don’t think the M4/3 world is dead or dying. Olympus could quite easily make that segment their own with Panasonic’s focus being elsewhere.

Oh, Pentax. Stormy skies are ahead. I am a Pentax user myself (K1 II, K-S2, and K1000), and I love their cameras. Pentax has a small (but passionate) user base. Pentax’s reluctance to move into the Mirrorless camera market and the slow pace of their lens development will ultimately drive the final nails into their coffin though.

I hate to say this because I love Pentax cameras, and I will continue to use mine for years to come. If we’re honest though, Pentax will not survive, and that’s a real shame. Fujifilm’s move into Medium Format has hurt Pentax and their 645Z too. I hope I am wrong about this, but if the likes of Canon and their ginormous camera market share is shrinking, Pentax is in for a rough ride. So small is the sales data for Pentax cameras that in sales reports they now get lumped into the ‘other’ category. This year is Pentax’s 100th anniversary, perhaps they will surprise us with a new vision for the future. If they want to stick around they need to do something fast.

What do you think about the comments the CEO of Canon has made? Where do you see the camera market in the next two years, and what do you think the fate of these companies will be? Let us know in the comment section below.